Smart Credit Card Insights

Discover the best credit cards, maximize rewards, and learn expert tips to make your cards work harder for you.

Card Features and Benefits

More Features

Rewards

A rewards credit card is designed to offer points, miles, or cashback for your spending, which you can later redeem for various benefits like shopping vouchers, flights, or statement credits

treval

A travel credit card is specially designed for people who travel frequently. It offers perks and rewards tailored to travel

Cashback

A cashback credit card gives back a percentage of your spending as cash rewards. Here's a breakdown

Your Day is Protected

Unlike other payment methods, credit cards allow consumers to maintain an ongoing balance of debt, which accrues interest over time.

Additionally, credit cards differ from cash cards, as the latter can be used like physical currency by the cardholder. Credit cards also contrast with charge cards in a key way: credit cards typically involve a third-party entity (such as a bank) that pays the merchant upfront and is later reimbursed by the cardholder, while charge cards operate differently.

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services.

The card issuer (usually a bank) creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance.

Choose Your Perfect Card

Customized offers fast and easy. Tell us who you are and what you like, to see what offers are available to you. It will only take a minute and won’t impact your credit score.

credit card

Here’s a comprehensive breakdown of major card types, their key features, and benefits to help you choose the best option

Card Type

Key Features

Benefits

| Rewards Credit Card | – Cashback/points on purchases – Bonus categories (e.g., 3% on dining) – Sign-up bonuses | Earn money back on spending (e.g., 1–5% cashback). Great for everyday use. |

| Travel Credit Card | – Airline miles/hotel points – Free checked bags, lounge access – Travel insurance | Save on flights, upgrades, and trips. Ideal for frequent travelers. |

| 0% APR Credit Card | – 0% interest for 12–18 months – Balance transfer options | Avoid interest on big purchases or debt consolidation. |

| Secured Credit Card | – Requires a security deposit – Reports to credit bureaus | Rebuild credit with low risk. Approval guaranteed with deposit. |

| Business Credit Card | – Higher spending limits – Expense tracking tools – Business rewards | Separate personal/business finances & earn perks. |

Frequently asked questions

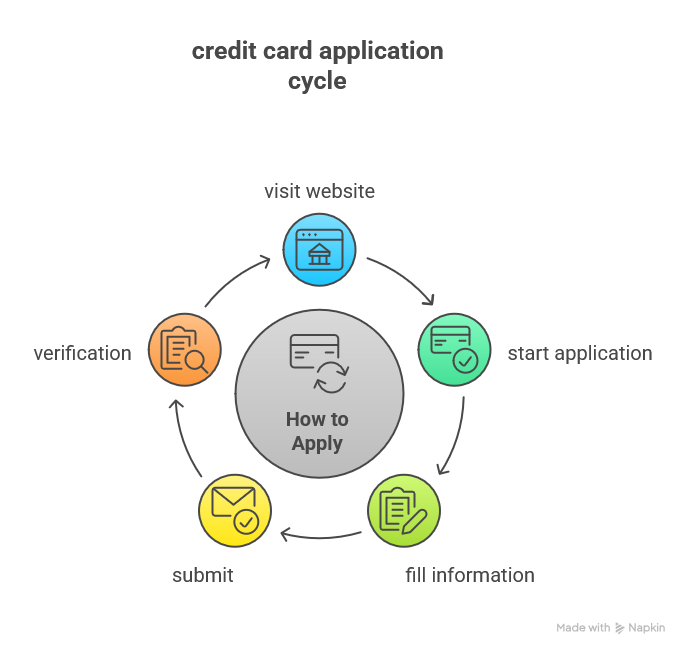

How to Get The Card

latest posts

HDFC Pixel Credit Card 2025: The Ultimate Guide

Credit cards have evolved a lot over the years—but what if your credit card actually understood your digital lifestyle? That’s where the HDFC Pixel Credit

Best Travel Credit Cards of 2025: Your Ultimate Guide to Smart Travel Spending

Traveling in 2025 has never been more rewarding, thanks to the plethora of travel credit cards offering a multitude of benefits. Whether you’re a frequent